*Not all investment options are available for every client, talk to us to develop the right customized investment approach for your assets*

Driving Down the Cost of Your Endowment - Hidden Fees

Our clients seek the best possible return on their capital. This makes sense – the return on an endowment is a major portion of the revenue needed for operational requirements for most organizations. But how do we, as professional financial investment advisors, approach investing capital and why should you invest with us? And what are the fees associated with our approach? In many circumstances our fees are lower than our competitors, especially after considering the hidden fees included by many other advisors that reduce your return. The Eco Endowment Solutions (EES) model has no hidden fees.

We use several approaches to drive fees lower. The first way we deliver a competitive fee structure is by charging an advisory fee that is below industry standards. It is far lower than those charged by Foundations and Community-based Funds. We do this because we have lower overhead than large organizations and because our mission is to return capital to the environment.

The second is through direct investments which eliminates a second layer of fees usually charged by other advisors. By purchasing investments directly, we negate the effect of hidden fees – asset managers and funds embed all sorts of fees into their investment platform, which you as the client are forced to absorb. We save you money through this direct investing approach.

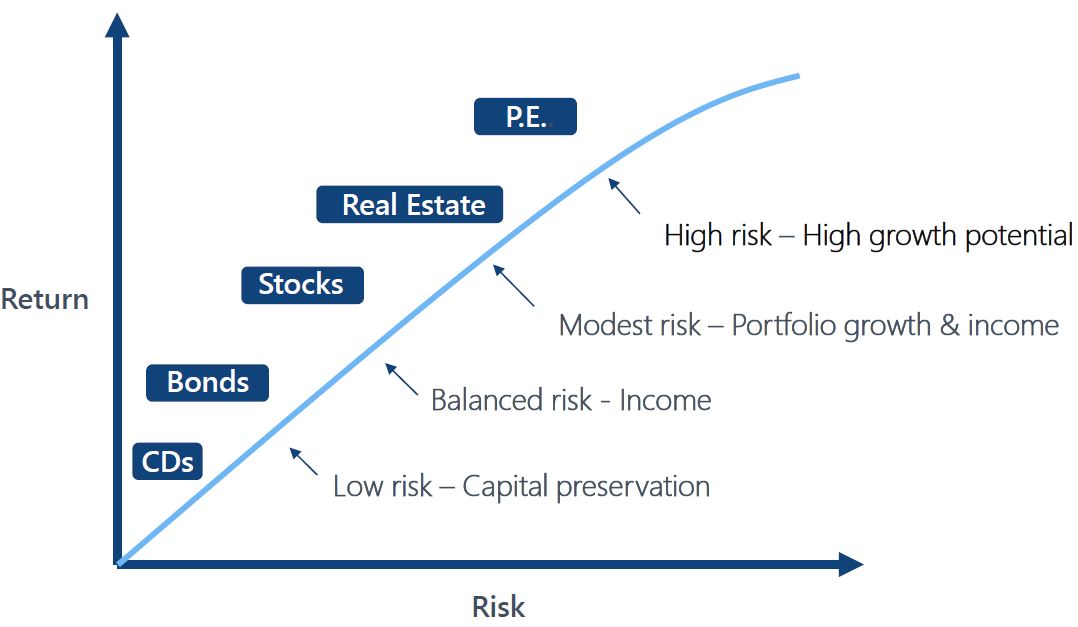

The EES approach to the risk versus reward ratio provides a range of potential investments an endowment or land trust can make. Investments can range from the highest growth potential but very risky private equity investment to low risk CDs and bonds which preserve capital, but typically result in relatively low returns. Not all investment options are right for each endowment, EES develops the right customized investment approach for your assets considering size of the endowment and financial needs. Smaller endowments may gravitate toward equities and bonds while larger endowments have more latitude for real estate and private equity investments.

Most other financial investors choose a portfolio based on funds – they pick one or more funds, drop your capital into it and leave it be, occasionally adjusting fund investment ratios. At EES we purchase investments directly - based upon our Financial Investment Advisor’s (Russell Silberstein) and the other analysts at Carmel Capital Partners research and recommendations. This allows us to pivot to market conditions as-needed. And, this cuts your fees by 100-basis points or more, which can lead to hundreds of thousands of dollars available for conservation-related undertakings instead of paying fund managers.

With the direct investment approach, we customize your portfolio to meet your organization’s needs – whether it is ESG investing (emphasizing a portfolio of companies that pay attention to Environmental, Sustainable and Governance issues), impact investing, or traditional return-focused approaches to portfolio management. It also means we can customize based on your goals. Different EES clients have various goals, risk tolerance profiles, and capital preservation needs leading to differing investment types.

Carmel Capital Partners is an SEC registered investment adviser. Carmel's investment advisory services are available only to residents of the United States in jurisdictions where Carmel is registered. Nothing in this material should be considered an offer, solicitation of an offer, or advice to buy or sell securities. Past performance is no guarantee of future results.

Any historical returns, expected returns [or probability projections] are hypothetical in nature and may not reflect actual future performance.

General Disclaimer: The information provided represents the opinion of Carmel Capital Partners and is not intended to be a forecast of future events or guarantee of future results. It is not intended to provide specific investment advice and should not be construed as an offering of securities or recommendation to invest. Not for use as a primary basis of investment decisions. Not to be construed to meet the needs of any particular investor. Not a representation or solicitation or an offer to sell/buy any security. Investors should consult with their investment professional for advice concerning their particular situation.

Carmel Capital Partners and their representatives do not provide legal advice. Your tax, legal and financial situation is unique. You should consult your legal advisor for advice and information concerning your particular situation.

Pursuant to the Securities Exchange Act of 1934, Carmel Capital Partners must provide clients with certain financial information.

Related posts

February 11, 2021