OUR SERVICES

Helping you achieve your

conservation and financial goals

The EES Model

-

Allows the land manager to retain influence on asset management with a customized investment portfolio while providing full transparency

-

Removes the need for foundations, big banks, and cookie-cutter financial approach meaning you pay lower fees

-

Provides regulators and board members with the comfort of independent third party oversite that understands land conservation and compliance requirements

Our Services

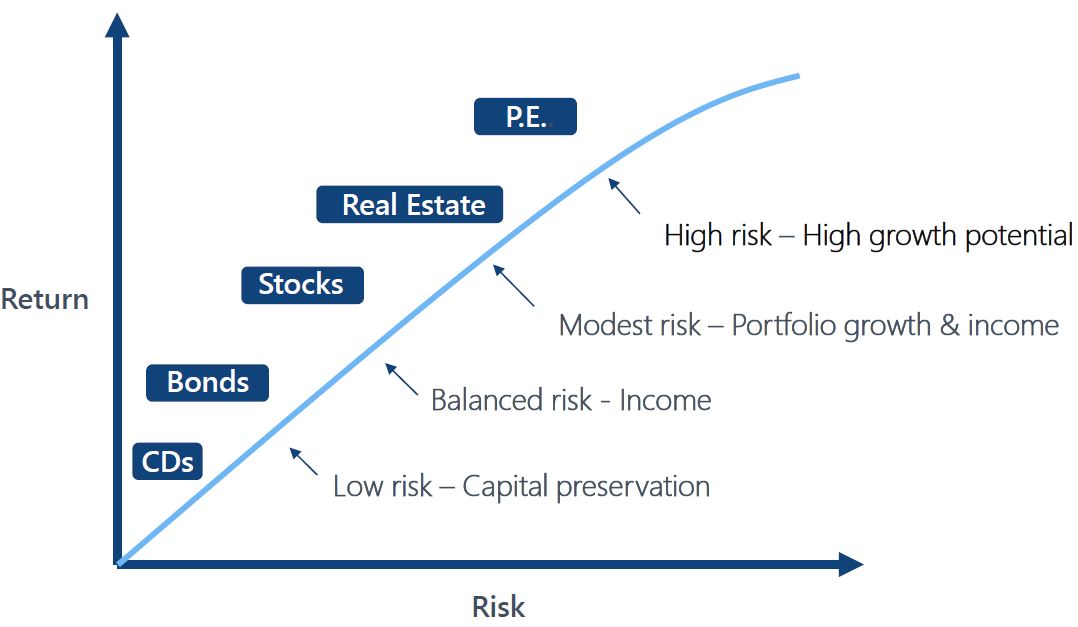

Customized Investment Portfolios

Strategic Financial Planning

Environment, Social, Governance (ESG) & Impact Investing

Endowment Establishment Support

Compliance with Federal & State Regulations

Cash Distributions to Meet Budgeting Needs

Online Reporting & Portal Access

Reporting for Board or External Regulators

Advice on Land Management Budgeting

Who We Serve

EES works with a variety of clients from both the private and public sectors.

The EES Difference

Placing your endowment capital in a big bank or foundation might be your first instinct, but large financial institutions are expensive, and lack transparency in fees and processes.

Foundations usually pool your capital into a fund and can be as bureaucratic as any regulatory agency. No matter how big your project is, you will always be a small client to them.

EES offers a better choice with full transparency in our processes, individualized portfolio management, lower fees, deep environmental knowledge, and customized financial support with your land management needs at the forefront.