The EES Approach to Sustainable Investing

Eco Endowment Solutions (EES) is a financial investment advisory firm that caters to the environmental industry. By our nature, we are focused on sustainability and environmental conservation. We invest capital on behalf of land trusts, conservation projects, mitigation banks, corporations invested in habitats, public spaces, national parks, and other environmentally focused entities and initiatives. And as investment advisors we must make decisions about where to place capital. That leads to questions our principal financial advisor, Russell Silberstein, faces daily.

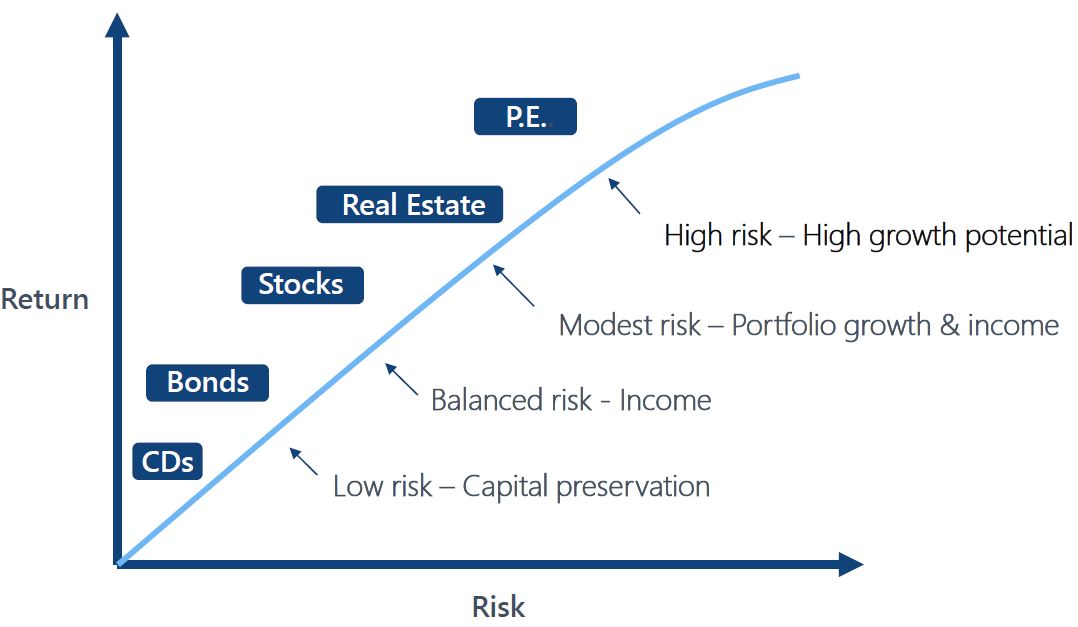

Three major movements in capital investing have been brewing for the past several years:

- Socially Responsible Investing (SRI)

- Environmental, Social and Corporate Governance (ESG) Investing

- Impact Investing

As you can imagine, EES focuses on each of these as well as more traditional investing.The genesis of these movements is the growing desire of consumers and investors to purchase products and invest in companies that address environmental and social issues and create appropriate governance to address sustainability.

What is Socially Responsible Investing?

SRI is an approach to preferentially invest in certain types of companies or excluding others. For instance, SRI investors might prefer solar companies and avoid gun manufacturers or tobacco companies. SRI represents a ‘values-driven’ investment approach. Some of our clients indeed request avoidance of certain industries and with the EES customized portfolio approach, this is easy to set up. SRI is customizable to an organization and EES is well equipped for SRI investing.

What are Environmental, Social and Corporate Governance Factors?

ESG is both a measurement system and a management approach. As a measurement system, ESG is criteria or framework to evaluate environmental and social risks and practices for companies. Companies that focus on ESG demonstrate their commitment to sustainable issues and manage their companies to remain resilient, which can make them a potentially valuable investment. Today a variety of research firms rank public companies according to ESG factors. Sustainalytics (https://www.sustainalytics.com/) ranks companies based on multiple ESG factors. Other firms, such as Morningstar (https://www.morningstar.com/) use this research and turn the rankings into suggested companies or funds of ESG companies in which to invest.

EES’s approach to ESG investing is to use our proprietary data combined with third-party research firms such as Sustainalytics and Morningstar to create suggested customized portfolios for our clients. This ensures our clients that have ESG investing mandates can achieve their goals using our services – and keeping costs down by eliminating asset managers fees.

What is Impact Investing?

Impact Investing seeks to measure the outcome of a sustainable investment. The goal is direct investment in a fund or organization that affects social or environmental change combined with a return on investment. EES has several approaches to impact investing – for instance, we have developed a relationship with Mission Driven Finance (https://www.missiondrivenfinance.com/), an impact driven fund manager as an example of our impact-investing approach.

Contact EES today for a free consultation and learn how we can help you achieve your investing goals.

Carmel Capital Partners is an SEC registered investment adviser. Carmel's investment advisory services are available only to residents of the United States in jurisdictions where Carmel is registered. Nothing in this material should be considered an offer, solicitation of an offer, or advice to buy or sell securities. Past performance is no guarantee of future results.

Any historical returns, expected returns [or probability projections] are hypothetical in nature and may not reflect actual future performance.

General Disclaimer: The information provided represents the opinion of Carmel Capital Partners and is not intended to be a forecast of future events or guarantee of future results. It is not intended to provide specific investment advice and should not be construed as an offering of securities or recommendation to invest. Not for use as a primary basis of investment decisions. Not to be construed to meet the needs of any particular investor. Not a representation or solicitation or an offer to sell/buy any security. Investors should consult with their investment professional for advice concerning their particular situation.

Carmel Capital Partners and their representatives do not provide legal advice. Your tax, legal and financial situation is unique. You should consult your legal advisor for advice and information concerning your particular situation.

Pursuant to the Securities Exchange Act of 1934, Carmel Capital Partners must provide clients with certain financial information.

Related posts

February 11, 2021