Expertise in Investment Management

Placing your endowment capital in a big bank or a foundation might be your first instinct, but large financial institutions are expensive, and lack transparency in fees and processes. Foundations usually pool your capital into a Fund and can be as bureaucratic as any regulatory agency. They also don’t understand your land conservation and compliance requirements. And, no matter how big your project is, you will always be a small client to them.

We offer offer transparency in our processes, individualized portfolio management with low fees, deep environmental knowledge, and customized and cost-effective financial support with your land management needs at the forefront:

Financial Planning & Investment Management

Reporting Requirements

Regulatory Compliance & Administrative Actions

Legal and Ecological Support

Habitat Management Obligations

How We Help You

Our key services include:

- Customized Investment Portfolios

- Reporting for Internal Board or External Regulators

- Compliance With Federal & State Regulations

- Cash Distributions to Meet Budgeting Needs

- Transparent Financial Decisions

- Advice on Land Management Budgeting

- Strategic Financial Planning

- Online Reporting & Portal Access

- Board Communication and Presentations

- Financial Forensic Evaluations

- Environmental, Social and Corporate Governance (ESG) Investing

- Impact Investing

Eco Endowment Solutions guides you through the myriad complications of endowment investing and regulatory reporting, managing the process on your behalf. And most of all, you don’t lose control of the capital and regulatory process.

Eco Endowment Solutions guides you through the myriad complications of endowment investing and regulatory reporting, managing the process on your behalf. And most of all, you don’t lose control of the capital and regulatory process. We strive to provide your land management requirements with adequate financial resources for long-term care while making sure that bothersome and complicated reporting is handled accurately.

We strive to provide your land management requirements with adequate financial resources for long-term care while making sure that bothersome and complicated reporting is handled accurately.

Easy 4-Step Starting Process:

1 – Free consultation with our investment managers

2 – Review investment plan and legal requirements – no charge

3 – Sign agreements

4 – Open investment account – no account opening fees

Once Active: Receive regular reports from EES and check account via online portal as often as you want!

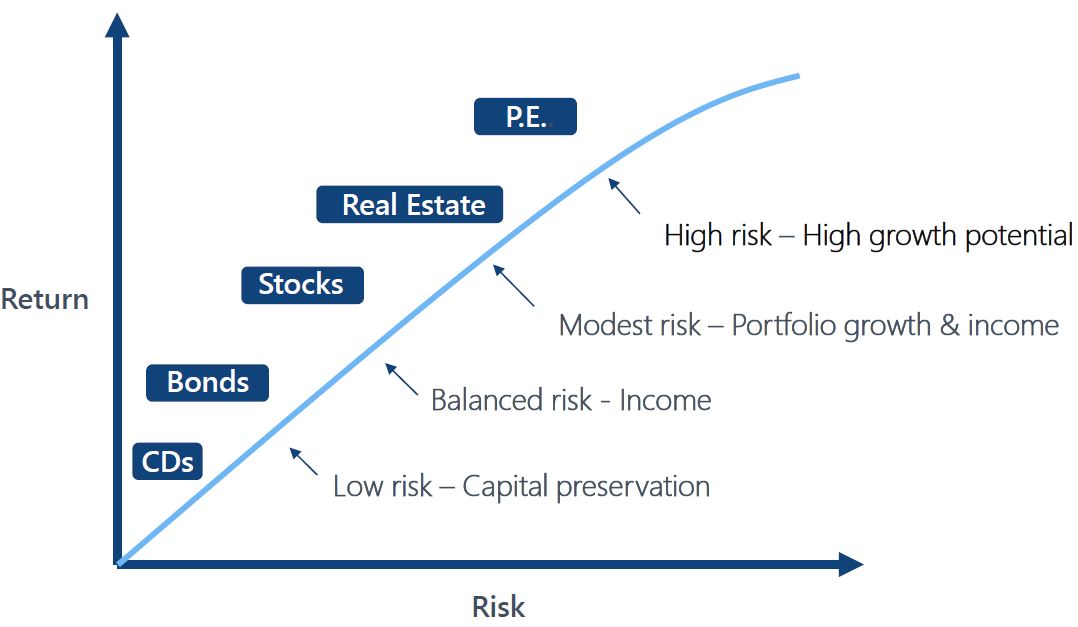

The EES Risk vs. Reward Ratio:

Talk to us to develop the right investing approach for YOUR assets.

We help you achieve your investing goals including ESG and impact investing.